Code of Conduct

The Code of Conduct is a collection of rules and principles intended to assist employees and directors in making decisions about their conduct in relation to the firm’s business. The Code is based on the fundamental understanding that we are all responsible for conducting business ethically and in compliance with the law everywhere we operate. No one should ever sacrifice integrity — or give the impression that they have — even if they think it would help the firm’s business. Access the JPMorgan Chase Code Of Conduct.

Code of Ethics for Finance Professionals

The purpose of the Code of Ethics for Finance Professionals is to promote honest and ethical conduct, and adherence with the law, particularly as related to the maintenance of JPMorgan Chase & Co.’s financial books and records and the preparation of External Financial Reporting. Noncompliance with applicable ethics laws and regulations can result in significant legal and regulatory exposure to the firm, as well as cause serious reputational harm.

The obligations outlined by this Code of Ethics are a supplement to, and do not replace employee responsibilities and obligations listed in the firm's Code of Conduct . Adherence to this Code of Ethics is a term and condition of employment for Finance Officers and Professionals. The firm will take all necessary actions to enforce it, up to and including immediate dismissal.

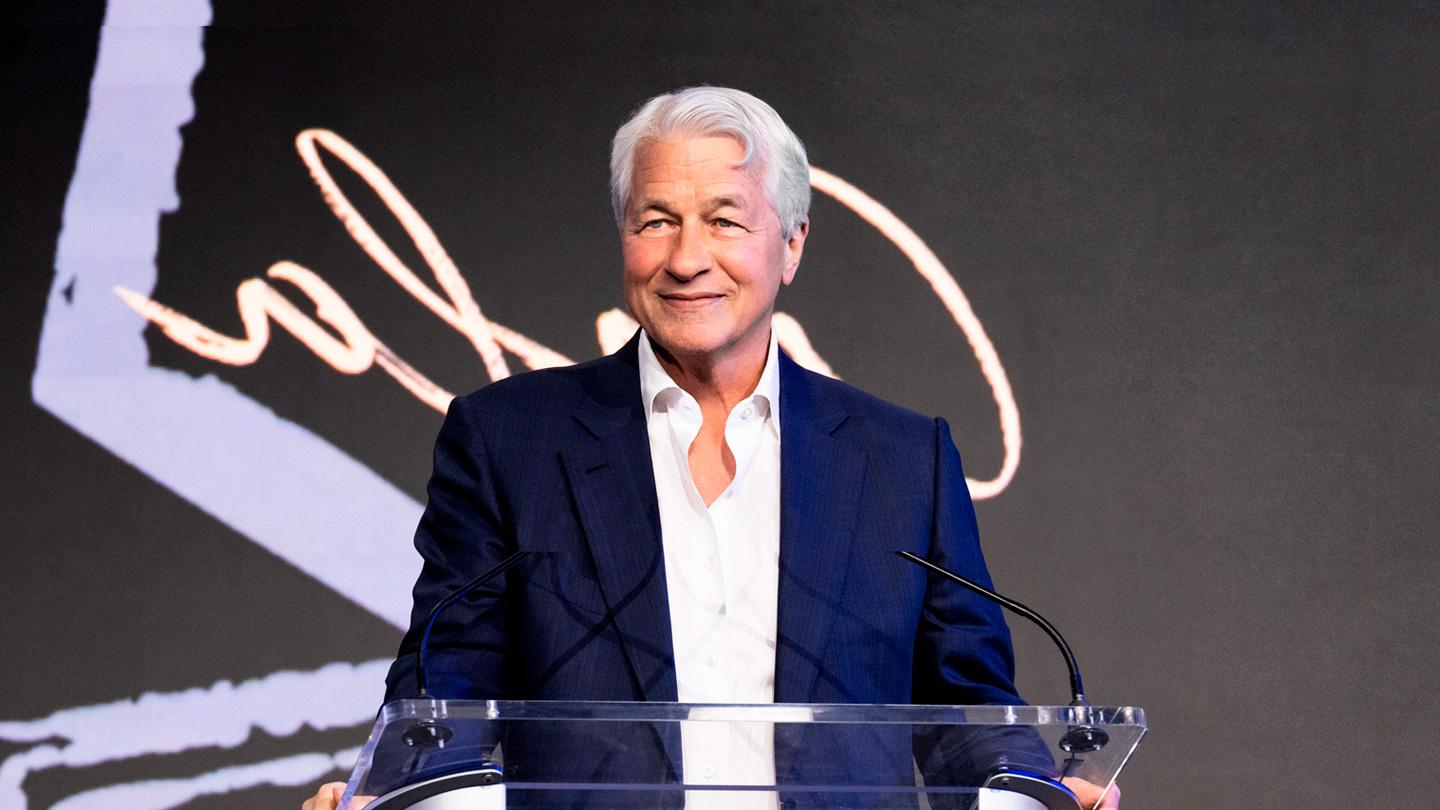

The Code of Ethics applies to the conduct and reporting requirements of the Chief Executive Officer, Chairman, Chief Financial Officer and Principal Accounting Officer of the firm (Finance Officers) and to all other professionals of the firm worldwide serving in a finance, accounting, treasury, tax or investor relations role (Finance Professionals).

Standards of Conduct

Finance Officers and Finance Professionals must act honestly, promote ethical conduct, and comply with the law, particularly as related to the maintenance of the firm's financial books and records and the preparation of External Financial Reporting, including U.S. Securities and Exchange Commission filings and other regulatory submissions. They are specifically required to:

- Carry out their responsibilities honestly, in good faith and with integrity, due care, competence and diligence.

- Never misrepresent or withhold material facts or allow their independent judgment to be compromised.

- Avoid actual or apparent conflicts of interest in personal and professional relationships.

- Comply with applicable government laws, rules and regulations of federal, state and local governments and other appropriate regulatory agencies.

- Never take, directly or indirectly, any action to coerce, manipulate, mislead or fraudulently influence the firm's independent auditors in the performance of their audit or review of the firm's External Financial Reporting, as applicable.

- Assist in the production of complete, accurate, timely and understandable External Financial Reporting and in other public communications made by the firm.

- Take all reasonable measures to protect the confidentiality of non-public information relating to the firm and its clients.

Reporting Requirements

Finance Officers and Finance Professionals must:

- Address actual or apparent conflicts of interest between personal and professional relationships by disclosing to their manager and appropriate Legal, Human Resources, or Compliance officer any material transaction or relationship that reasonably could be expected to give rise to such a conflict, including but not limited to those with firm customers, suppliers, business associates, and employees with whom they work and/or support, and

- Promptly report (anonymously, where permitted by law) any potential or actual violation of the Code of Ethics or any other matters that may compromise the integrity of the firm’s External Financial Reporting

Reports may be made to the JPMC Conduct Hotline or in any of the ways set forth in the Code of Conduct (see below).

The reporting requirements do not prevent employees from reporting to the government or regulators conduct that the employee believes to be in violation of law, and it does not require employees to notify the firm prior to reporting to the government or regulators.

The firm strictly prohibits intimidation or retaliation against anyone who makes a good faith report about a potential or actual violation of the Code of Ethics, or of any law or regulation governing the firm’s business. The firm also strictly prohibits any intimidation or retaliation against anyone who assists with an inquiry or investigation of any such violation.

Reporting by phone

1-855-JPMCODE (576-2633) in the U.S. and Canada only

All others click here

Calling the toll-free JPMC Conduct Hotline is the easiest way to make a report. You will speak with a trained interviewer (who is not a firm employee). Translation services are available. The Hotline and online resources are available 24 hours a day, 7 days a week.

Other reporting methods

Report online

www.tnwgrc.com/JPMC

Email

fraud.prevention.and.investigation@jpmchase.com